Buy-to-Let Mortgages

Tailored funding solutions for property investors.

If you’re planning to invest in property and earn rental income, a Buy to Let mortgage is an essential step in making it happen.

A specialist mortgage adviser can guide you through the process, helping you find the most suitable lenders, secure competitive rates, and navigate the specific criteria involved with Buy to Let lending, making the journey smoother from start to finish.

Understanding what a Buy-to-Let Mortgage is

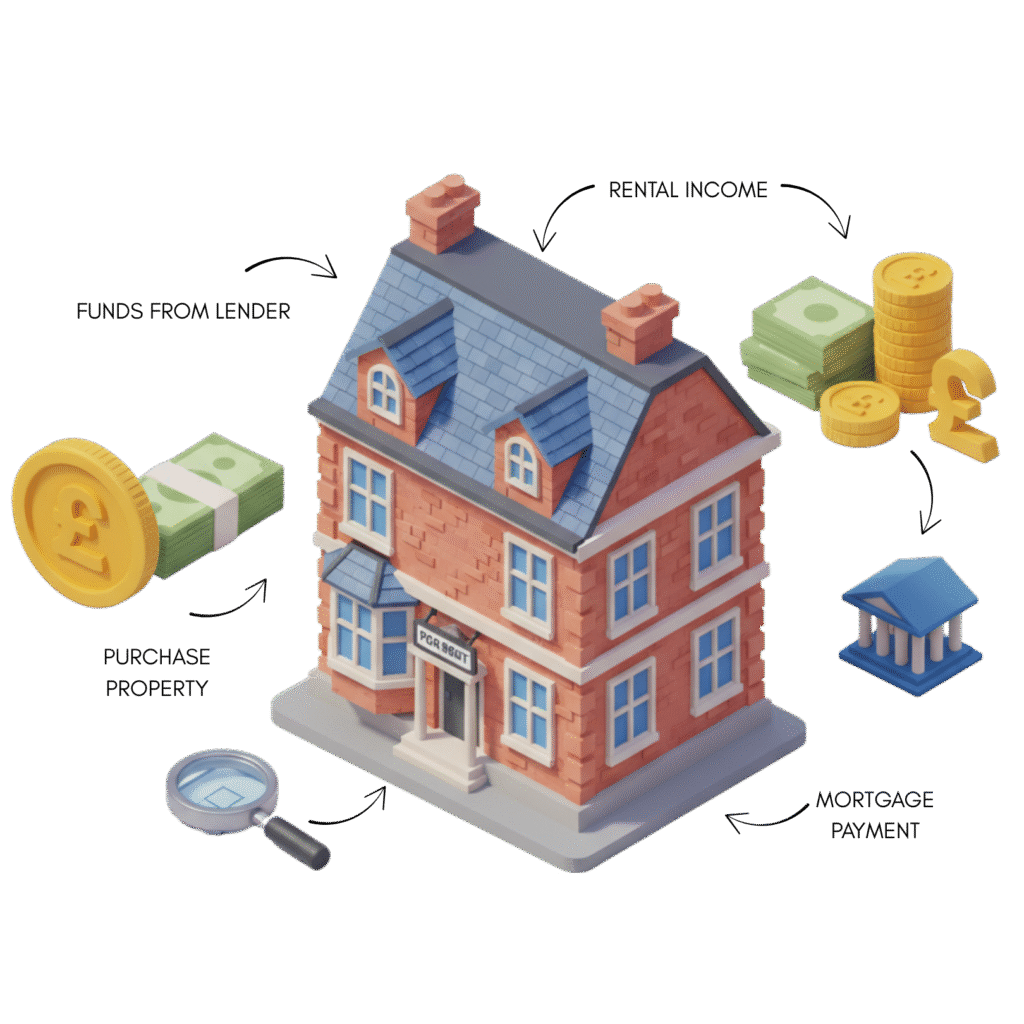

A Buy-to-Let (BTL) Mortgage is a specialist loan designed for landlords purchasing a property to rent out. Unlike residential mortgages, which are for buyers acquiring a home to live in, Buy-to-Let Mortgages cater specifically to property investors and landlords.

Typically, Buy-to-Let mortgages are offered on an interest-only basis, helping to keep monthly repayments low. Lenders usually require a deposit of at least 20%, as they provide funding for up to 80% of the property’s value.

Because Buy-to-Let mortgages are considered higher risk due to the reliance on rental income, they fall into the category of specialist lending. As a result, they can be more challenging to qualify for than standard residential mortgages.

Understanding what a Buy to Let mortgage is.

A Buy-to-Let (BTL) mortgage is a specialist loan designed for landlords purchasing a property to rent out. Unlike residential mortgages, which are for buyers acquiring a home to live in, Buy-to-Let mortgages cater specifically to property investors and landlords.

Typically, Buy-to-Let mortgages are offered on an interest-only basis, helping to keep monthly repayments low. Lenders usually require a deposit of at least 20%, as they provide funding for up to 80% of the property’s value.

Because Buy-to-Let mortgages are considered higher risk due to the reliance on rental income, they fall into the category of specialist lending. As a result, they can be more challenging to qualify for than standard residential mortgages.

How Buy-to-Let Mortgages work

Buy-to-Let Mortgages provide landlords with the funding needed to purchase or remortgage investment properties. Whether you’re a first-time landlord or a seasoned investor, these loans are tailored to help you achieve your property goals.

Here are the types of landlords we support at Power Mortgages:

- First-Time Landlords – Securing their first Buy-to-Let mortgage with expert guidance.

- Existing Landlords – Looking to refinance or grow their portfolio.

- Portfolio Landlords – Managing multiple properties with customized lending options.

- Refinancing – Securing better rates or adjusting terms for improved cash flow.

- Capital Raising – Leveraging equity to fund new property purchases or for any other legal purpose.

- Residential to Buy-to-Let – Transitioning from personal use to rental income.

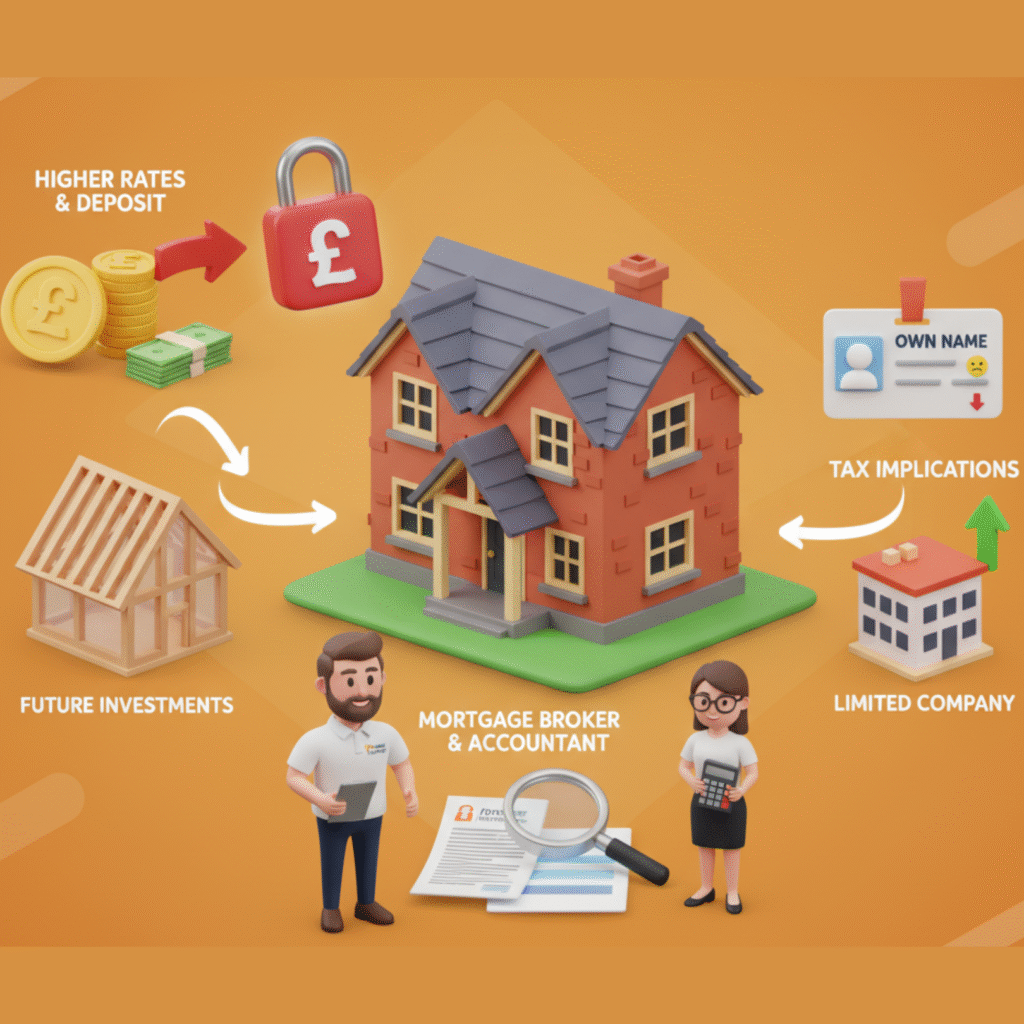

Important Considerations for Buy-to-Let Mortgages

Buy-to-Let Mortgages rates are typically higher than residential mortgage rates, and lenders often require a larger deposit. Many landlords choose to remortgage their existing properties to raise funds for future investments.

Working with an experienced mortgage broker and accountant is crucial to getting the most from your Buy-to-Let Mortgage. For example, the decision to purchase in your own name or through a limited company can have significant tax implications.

At Power Mortgages, we specialise in helping landlords navigate these complex decisions, ensuring you have the right funding and expert advice to build a successful property portfolio.

Important Considerations for Buy-to-Let Mortgages

Buy-to-Let mortgage rates are typically higher than residential mortgage rates, and lenders often require a larger deposit. Many landlords choose to remortgage their existing properties to raise funds for future investments.

Working with an experienced mortgage broker and accountant is crucial to getting the most from your Buy-to-Let mortgage. For example, the decision to purchase in your own name or through a limited company can have significant tax implications.

At Power Mortgages, we specialise in helping landlords navigate these complex decisions, ensuring you have the right funding and expert advice to build a successful property portfolio.

How a Buy-to-Let Mortgage Broker

Can Help You Secure the Best Deals

As a Buy-to-Let Mortgage broker Power Mortgages specialises in guiding landlords, whether seasoned investors or first-time landlords through the process of finding and securing the most suitable mortgage deals for their property investments. As Buy-to-Let mortgages are a specialist area of lending, working with a broker who has expert knowledge of criteria and options is essential for success.

At Power Mortgages, our experienced team takes the hassle out of the process by managing everything from start to finish. Here’s how we can help you:

- Buy-to-Let Purchases – Simplifying the process of financing new investment properties.

- Buy-to-Let Remortgages – Assisting you in refinancing to reduce costs or release equity.

- Capital Raising – Releasing funds to expand your portfolio or invest further.

- HMO Limited Company Mortgages – Providing tailored solutions for Houses in Multiple Occupation.

- Limited Company Mortgages – Providing specialist advice on company structures and Limited Company Mortgages

- New Fixed Rate Deals – Securing competitive rates to keep your costs predictable.

- Auction Finance – Arranging fast financing for time-sensitive auction purchases.

- Bridging Loans – Offering short-term funding to ensure seamless property transactions.

- Complex Buy-to-Let Cases – Delivering expert solutions for unique or challenging scenarios.

Many landlords choose Power Mortgages not just for our expertise but for the ongoing support we provide. From reviewing your portfolio to refinancing for improved terms, we’re here to ensure your investments perform at their best.

Partner with Power Mortgages today to secure the best deals and make the most of your Buy-to-Let ventures.

Frequently Asked Questions

Frequently asked questions about Buy-to-Let (BTL) mortgages

How does a Buy-to-Let mortgage differ from a residential mortgage?

What deposit is required for a Buy-to-Let mortgage?

Lenders usually require a deposit of at least 25% of the property’s value, though some may accept as little as 15%. However, a larger deposit often secures more favourable interest rates.

Can first-time buyers obtain a Buy-to-Let mortgage?

Yes, first-time buyers can apply for a Buy-to-Let mortgage, but the criteria are often stricter, and fewer lenders may be willing to offer a loan.

How is the loan amount determined for a Buy-to-Let mortgage?

The loan amount is primarily based on the expected rental income from the property. Lenders typically require the rental income to cover between 125% and 145% of the monthly mortgage payments.

Are Buy-to-Let mortgages offered on an interest-only basis?

Yes, many Buy-to-Let mortgages are available on an interest-only basis, meaning you pay only the interest each month and repay the full loan amount at the end of the mortgage term.

What are the tax implications of a Buy-to-Let property?

Landlords are subject to income tax on rental profits, capital gains tax on property sales, and may also need to pay stamp duty surcharges on additional properties. It’s advisable to consult a tax professional for detailed guidance.

Can I use my personal income to support a Buy-to-Let mortgage application?

Yes, some lenders consider personal income, especially if the rental income doesn’t meet their criteria. However, the primary focus is usually on the property’s rental potential.

Do I need a specific type of property insurance for a Buy-to-Let property?

Yes, landlords should obtain landlord insurance, which covers risks associated with renting out property, including building and contents insurance, and liability protection.

Can I live in my Buy-to-Let property?

Yes, landlords should obtain landlord insurance, which covers risks associated with renting out property, including building and contents insurance, and liability protection.

What fees are associated with Buy-to-Let mortgages?

Fees may include arrangement fees, valuation fees, legal fees, and broker fees. These can vary between lenders and should be factored into the overall cost of the mortgage.

Is there an age limit for obtaining a Buy-to-Let mortgage?

Some lenders do not have a maximum age for buy to let, but there are some who will have an upper age limit which could be between 80-90 years old at the end of the mortgage term.

Can I get a Buy-to-Let mortgage through a limited company?

Yes, purchasing through a limited company is an option and can offer tax advantages, though mortgage rates and fees may be higher. It’s important to seek professional advice to understand the implications.

What is a House in Multiple Occupation (HMO), and can I get a mortgage for one?

An HMO is a property rented out to multiple tenants who share facilities. Specialist HMO mortgages are available, but they often come with stricter criteria and higher interest rates.

How does remortgaging a Buy-to-Let property work?

Remortgaging involves switching your existing mortgage to a new deal, either with the same lender or a different one, to secure a better interest rate or release equity from the property.

What is the stress test in Buy-to-Let mortgages?

Lenders apply a stress test to ensure you can afford mortgage payments if interest rates rise. This involves assessing whether the rental income would still cover the mortgage payments at a higher interest rate.

Can I switch my residential mortgage to a Buy-to-Let mortgage?

Yes, if you plan to rent out your current home, you’ll need to switch to a Buy-to-Let mortgage. This process is known as a “let-to-buy” mortgage.

Are there restrictions on the type of property for a Buy-to-Let mortgage?

Yes, some lenders have restrictions on property types, such as studio flats, ex-local authority properties, or properties above commercial premises. It’s important to check lender criteria before purchasing.

Do I need a tenancy agreement for my tenants?

Yes, having a formal tenancy agreement, typically an Assured Shorthold Tenancy (AST), is essential to outline the terms and conditions of the tenancy and protect both landlord and tenant rights.

Can I use projected rental income from Airbnb or short-term lets for a Buy-to-Let mortgage?

Most lenders prefer long-term tenancy agreements and may not accept projected income from short-term lets like Airbnb. However, some specialist lenders might consider it.

What happens if my property is vacant and I can't meet mortgage payments?

As a landlord, you’re responsible for mortgage payments regardless

Can I apply for a Buy-to-Let mortgage if I have bad credit?

Yes, there are lenders who specialise in offering Buy-to-Let mortgages for applicants with adverse credit histories. However, you may face higher interest rates or require a larger deposit.

Do I need an existing property portfolio to get a Buy-to-Let mortgage?

No, you don’t need an existing portfolio. Many lenders offer Buy-to-Let mortgages to first-time landlords, though criteria may be stricter compared to experienced investors.

How long does it take to get a Buy-to-Let mortgage approved?

The process typically takes 4-8 weeks, depending on the complexity of your application, lender requirements, and the time it takes to complete valuations and legal checks

Are there fixed-rate Buy-to-Let mortgages available?

Yes, many lenders offer fixed-rate Buy-to-Let mortgages, which provide predictable payments over a set period, such as two, five, or even ten years. These are popular for budgeting stability.

Can I refinance my Buy-to-Let mortgage to release equity for another property purchase?

Yes, remortgaging is a common way for landlords to release equity, which can be used as a deposit for purchasing additional investment properties.