Let-to-Buy Mortgages

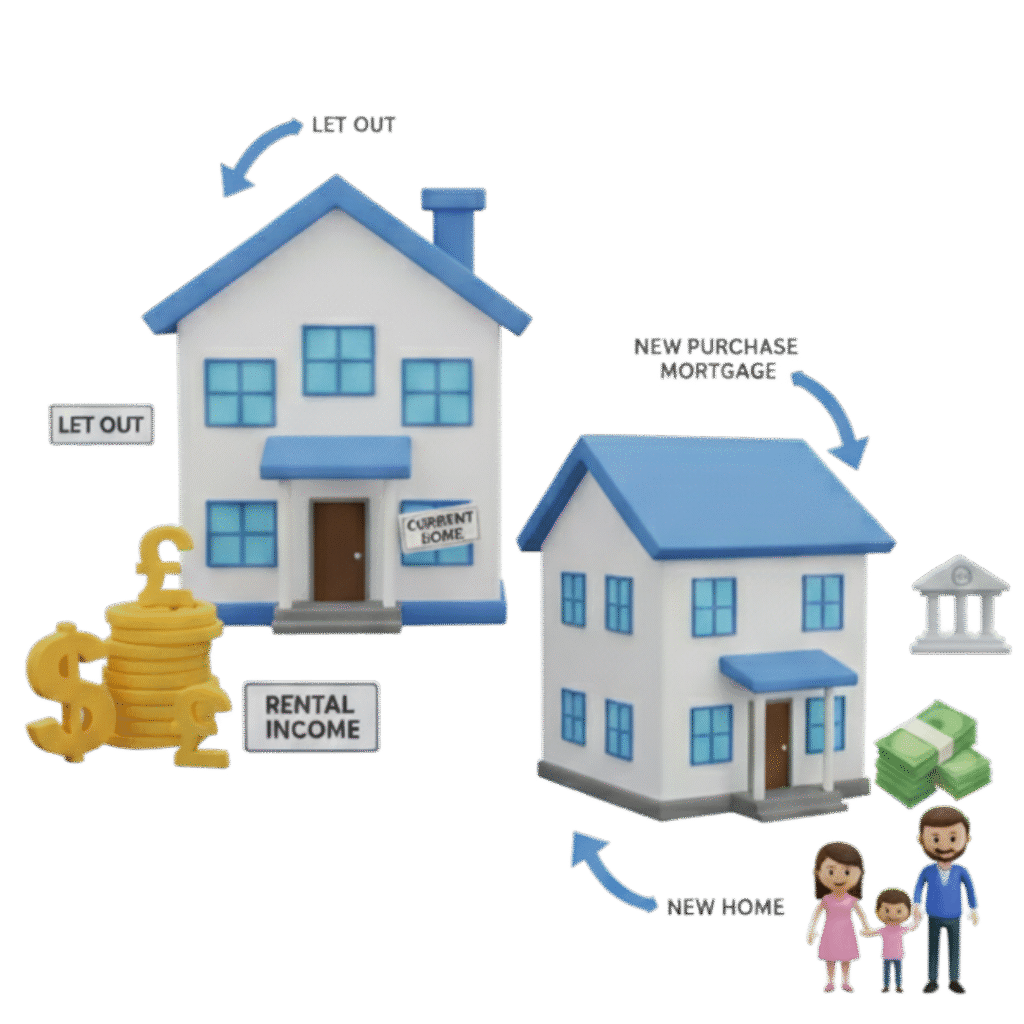

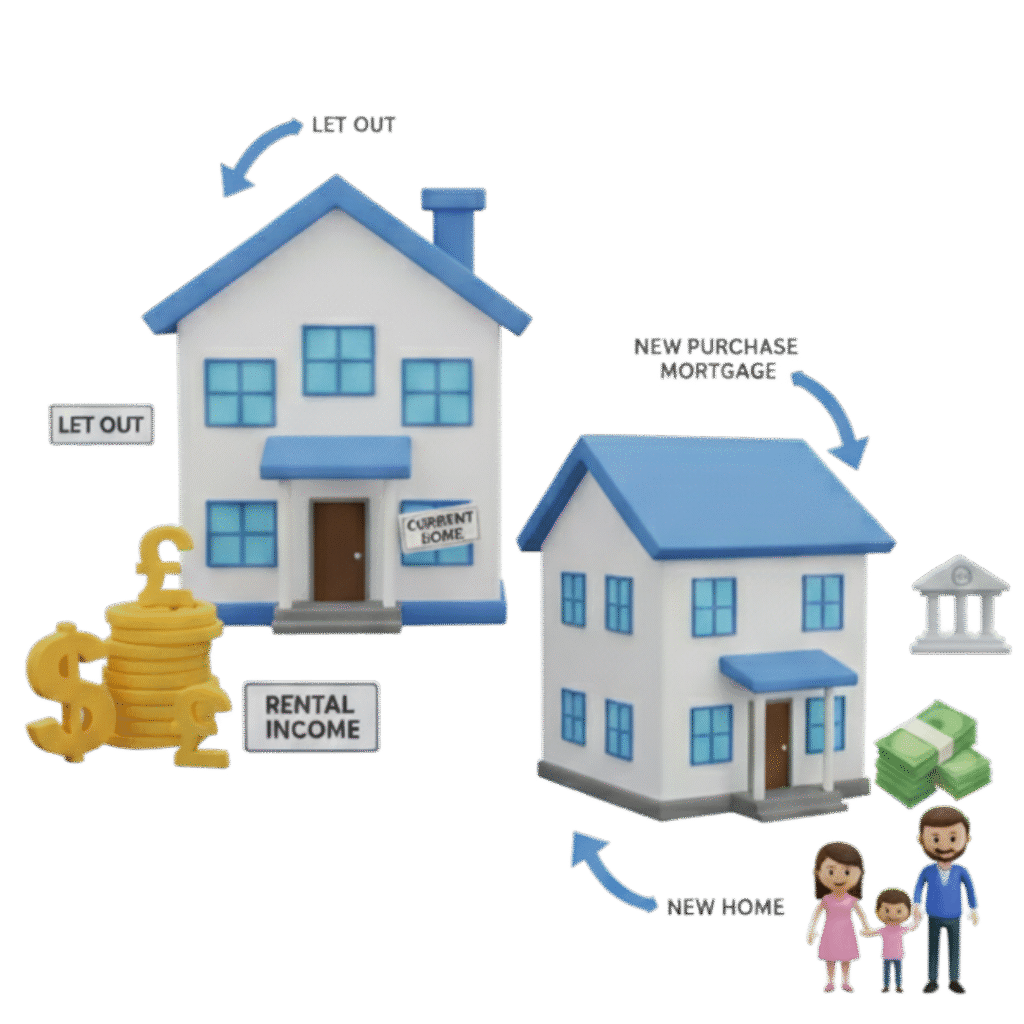

Unlock the potential to rent out your current home while purchasing a new one.

What is a Let-to-Buy Mortgage?

Let-to-buy mortgages are a fantastic option for homeowners who want to retain their current property as a rental investment while moving into a new home. This type of mortgage allows you to convert your existing home into a Buy-to-Let property, enabling you to generate rental income and embark on your next chapter with confidence.

At Power Mortgages, we specialise in Let to Buy solutions, offering expert guidance to make the process straightforward and stress-free. Whether you’re relocating, upsizing, or exploring the opportunity to become a landlord, our experienced brokers are here to help.

With a Let to Buy mortgage, you can:

- Arrange a Buy-to-Let mortgage for your current home.

- Secure a residential mortgage for your new property.

- Release equity from your existing home to support your next purchase.

Successfully navigating a Let to Buy arrangement requires expert advice to ensure the best financial and property outcomes. At Power Mortgages, we’re here to offer tailored solutions, access exclusive deals, and handle the complexities for you.

What is a Let to Buy mortgage?

Let to Buy mortgages are a fantastic option for homeowners who want to retain their current property as a rental investment while moving into a new home. This type of mortgage allows you to convert your existing home into a Buy-to-Let property, enabling you to generate rental income and embark on your next chapter with confidence.

At Power Mortgages, we specialise in Let to Buy solutions, offering expert guidance to make the process straightforward and stress-free. Whether you’re relocating, upsizing, or exploring the opportunity to become a landlord, our experienced brokers are here to help.

With a Let to Buy mortgage, you can:

- Arrange a Buy-to-Let mortgage for your current home.

- Secure a residential mortgage for your new property.

- Release equity from your existing home to support your next purchase.

Successfully navigating a Let to Buy arrangement requires expert advice to ensure the best financial and property outcomes. At Power Mortgages, we’re here to offer tailored solutions, access exclusive deals, and handle the complexities for you.

What does a Let-to-Buy Mortgage Broker do?

A Let to Buy mortgage broker is your trusted partner in navigating the complexities of converting your current home into a rental property while securing a new home for yourself. Their expertise lies in managing the dual mortgage applications required for a Let to Buy arrangement and ensuring you get the best deals tailored to your needs.

Here’s how a Let to Buy mortgage broker can help:

- Provide Expert Advice

Let to Buy mortgages involve unique criteria for both Buy-to-Let and residential loans. A broker will assess your circumstances, explain your options, and recommend the best approach for your goals.

2. Find the Best Mortgage Deals

With access to a wide range of lenders, including exclusive and specialist deals, a broker can secure competitive rates for both your Buy-to-Let and residential mortgages.

- Manage Both Applications

Coordinating two separate mortgage applications can be overwhelming. Your broker ensures both processes align smoothly, handling all paperwork and communication with lenders.

- Navigate Complex Criteria

Lenders often have stringent requirements, such as rental income projections for your current home and affordability checks for your new one. A broker ensures your applications meet these criteria, reducing the risk of delays or rejections.

- Offer Tailored Solutions

Whether you’re a first-time landlord or a seasoned investor, a broker provides personalised guidance, taking into account factors like equity release, tax implications, and property valuations.

- Save You Time and Stress

A Let to Buy mortgage broker streamlines the entire process, so you can focus on planning your next move while they handle the details.

Why Choose Power Mortgages?

At Power Mortgages, we specialise in Let to Buy solutions, offering unparalleled expertise and customer-focused service. From helping you unlock equity to finding the best deals, we’re here to make your Let to Buy journey hassle-free.

Ready to make your move? Contact Power Mortgages today to get started.

Frequently Asked Questions

Frequently Asked Questions about Let-to-Buy Mortgages

What is a Let-to-Buy mortgage?

A Let to Buy mortgage allows homeowners to rent out their current property by converting their existing residential mortgage into a Buy to Let mortgage, while simultaneously purchasing a new residential property to live in.

How does a Let-to-Buy mortgage differ from a Buy to Let mortgage?

While both involve renting out a property, a Let to Buy mortgage specifically refers to the scenario where you let your existing home and buy a new one to reside in. In contrast, a Buy to Let mortgage is typically used to purchase a property solely for rental income purposes.

What are the eligibility criteria for a Let -to-Buy mortgage?

Eligibility criteria often include having sufficient equity in your current property, a stable income to support the new residential mortgage, a good credit history, and the projected rental income meeting the lender’s requirements.

How much deposit is required for the new residential property in a Let-to-Buy arrangement?

Lenders typically require a deposit of at least 10-% for the new residential property, though this can vary based on individual circumstances and lender policies.

Are there tax implications with a Let-to-Buy mortgage?

Yes, renting out your property may subject you to income tax on rental earnings. Additionally, purchasing a new property while retaining your existing one could incur higher Stamp Duty charges, as it may be considered a second home.

Can I switch back to a residential mortgage if I decide to move back into my original property?

Yes, you can switch back to a residential mortgage if you decide to move back into your original property. However, this would require fulfilling the criteria for a residential mortgage at that time.

How do lenders assess rental income for a Let-to-Buy mortgage?

Lenders typically require a rental income projection, often conducted by a professional valuer, to ensure it meets a certain percentage over the mortgage payments, commonly around 125-145%.

What happens if I can't find tenants for my property?

Periods without tenants, known as ‘void periods’, pose a financial risk as you’ll need to cover the mortgage without rental income. Having a financial buffer to cover these periods is advisable. Effective marketing and competitive pricing can also help minimize void periods.

Are Let-to-Buy mortgages regulated?

The residential part of a Let to Buy mortgage is regulated by the Financial Conduct Authority (FCA), while the Buy to Let part is usually not, as it’s considered a business transaction.

Can I use a Let-to-Buy mortgage if I have an existing Buy to Let property?

Yes, having an existing Buy to Let property doesn’t typically affect your ability to obtain a Let to Buy mortgage, provided you meet the lender’s criteria.

How does Stamp Duty work on a Let-to-Buy mortgage?

Purchasing a second home means that you will be exposed to Stamp Duty rates, beginning at 3%. Levies can be as much as 15% depending on how much your second property purchase is worth. Stamp Duty is reclaimable if you sell your existing home within three years, although you need to claim within one year of the sale.

Do I need permission from my current lender to let out my property?

Yes, you must inform your current lender if you intend to rent out your property. They may grant ‘consent to let’ or require you to switch to a Buy to Let mortgage.

Are there specific lenders that offer Let-to-Buy mortgages?

Yes, several lenders offer Let to Buy mortgages, though availability may vary. Consulting with a mortgage broker can help identify suitable lenders for your situation.

How does a Let-to-Buy mortgage affect my credit score?

Managing two mortgages can impact your credit score, especially if payments are missed. However, timely payments can help maintain or even improve your credit rating.

Can I use rental income to help secure the new residential mortgage?

Some lenders may consider projected rental income when assessing your affordability for the new residential mortgage, but policies vary.

What insurance considerations are there with a Let-to-Buy mortgage?

You’ll need landlord insurance for the rented property and standard home insurance for your new residence.

Are Let-to-Buy mortgages available for all property types?

Not all property types are eligible; for instance, some lenders may have restrictions on flats above commercial premises or non-standard constructions.

Can I make overpayments on a Let-to-Buy mortgage?

Overpayment options depend on the lender’s terms. Some allow overpayments without penalties, while others may charge fees.

How long does the Let-to-Buy mortgage process take?

The process duration varies but typically takes a few weeks to a couple of months, depending on individual circumstances and lender efficiency.

Is a Let-to-Buy mortgage suitable for everyone?

Let to Buy mortgages can be complex and may not suit everyone’s financial situation. It’s essential to seek professional advice to determine if it’s the right option for you.

Client Testimonial

“We were feeling completely stuck. We needed to move to a larger house because of our growing family, but we didn’t want to rush into selling our current home in a tough market. We’d heard about Let to Buy mortgages but had no idea how it worked or whether we’d even qualify.

We got in touch with Power Mortgages, and honestly, they made the whole process feel possible. Our adviser, Manny, walked us through every step and he explained things clearly, found us competitive rates, and handled both mortgage applications at the same time. What really stood out was how calm and responsive he was. We’re now settled into our new home and still earning rental income from the old one. We really couldn’t have done it without him.”

Sarah and David Thompson

Client Testimonial