Interest-Only Buy-to-Let Mortgage

Maximise your rental income with an Interest-Only Buy to Let Mortgage, designed to lower monthly payments by focusing solely on interest.

We’re here to guide you through understanding how it works, exploring tailored options, and calculating borrowing based on your rental income.

What is an Interest-Only Buy-to-Let Mortgage?

An Interest-Only Buy-to-Let Mortgage allows landlords to pay just the interest on their loan each month, rather than repaying the capital. This setup reduces monthly costs significantly, making it an attractive option for those looking to maximise rental income.

The remaining capital is typically repaid at the end of the mortgage term. This can be done using savings, selling the property, or through other investments. Planning for this repayment is crucial to avoid financial challenges later.

This type of mortgage is popular with landlords because it helps improve cash flow, leaving more funds available for property maintenance or expanding their portfolio. However, understanding the risks and requirements is essential.

Who Can Benefit from an Interest-Only Buy-to-Let Mortgage?

Interest-Only Buy-to-Let Mortgages are ideal for landlords aiming to minimise monthly expenses while maximising rental yields. It’s particularly suitable for experienced landlords managing multiple properties.

First-time landlords can also benefit from this mortgage type, but they may need to meet stricter lending criteria, such as a larger deposit and higher rental income coverage. Lenders assess these factors carefully to ensure affordability.

For those with long-term investment strategies, the lower payments can free up funds to reinvest in additional properties or improve existing ones. However, careful financial planning is essential to manage the capital repayment.

How a Mortgage Broker Can Help with Interest-Only Buy-to-Let Mortgages

A mortgage broker can simplify the process of finding an Interest-Only Buy to Let Mortgage by offering tailored advice and access to a range of lenders. This ensures you secure a deal that aligns with your goals.

Brokers can also help calculate affordability based on your expected rental income and identify lenders who specialise in interest-only products. Their expertise can save you time and improve your chances of approval.

From initial advice to completing the application, a broker supports you at every stage, ensuring a smooth and stress-free process. They’ll help you understand repayment options and make informed decisions about your property investment.

Frequently Asked Questions

Frequently Asked Questions: Declined Buy-to-Let Mortgage Applications

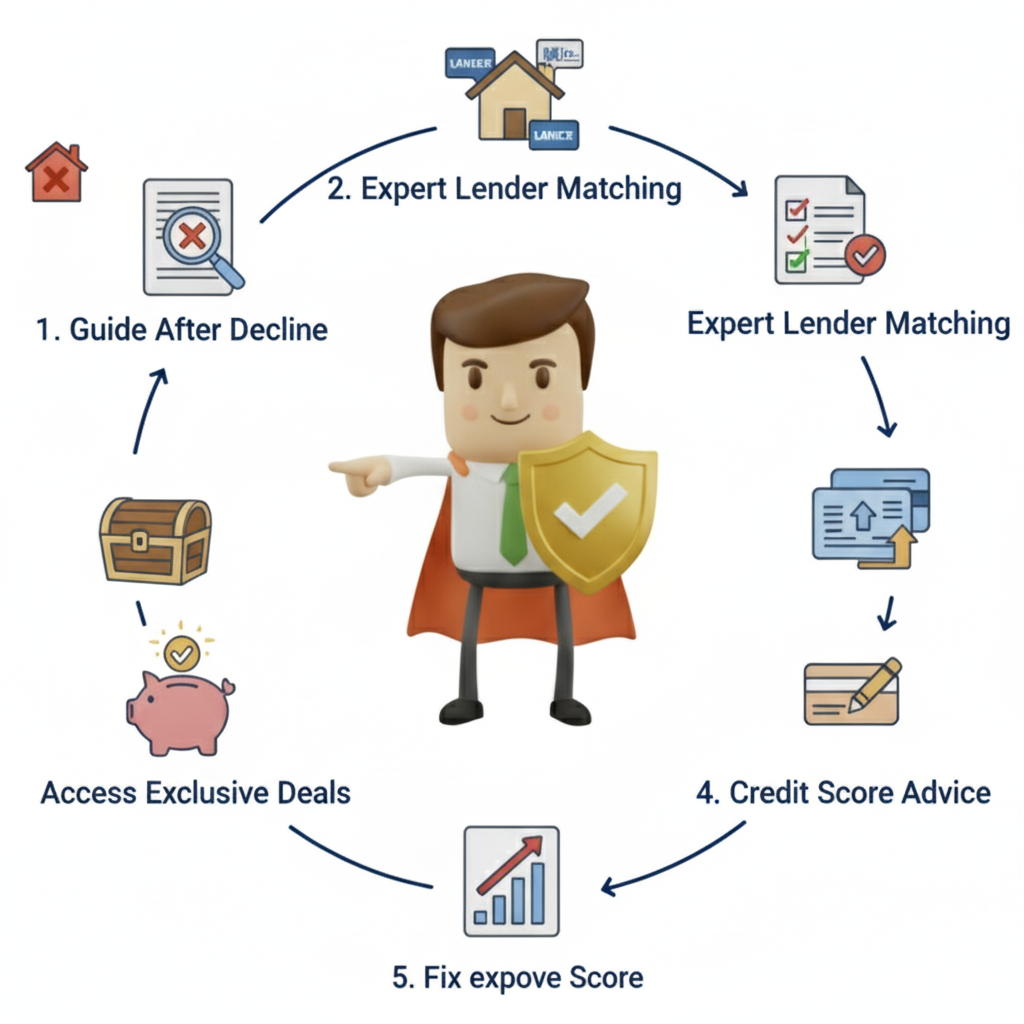

Why was my Buy-to-Let mortgage application declined?

Lenders may decline applications due to insufficient rental income, poor credit history, property type or not meeting their affordability criteria.

Can I reapply if my Buy-to-Let mortgage was declined?

Yes, but it’s essential to address the reasons for the rejection before reapplying. A mortgage broker can guide you through the process.

Does a declined Buy-to-Let mortgage affect my credit score?

A decline itself doesn’t impact your score, but multiple applications can lower it. Always check eligibility before applying.

What rental income do lenders require for Buy-to-Let mortgages?

Typically, rental income must cover 125–145% of the mortgage payments, depending on the lender and your tax status.

Can I get a Buy-to-Let mortgage with bad credit?

Some lenders specialise in helping applicants with poor credit. A broker can connect you with these options.

Will I need a higher deposit if my Buy-to-Let mortgage was declined?

In some cases, increasing your deposit can make your application more attractive to lenders.

Can I appeal a declined Buy-to-Let mortgage application?

It’s unlikely to change the decision, but understanding why it was declined can help you address issues for future applications.

Do lenders decline Buy-to-Let mortgages based on property type?

Yes, certain property types, like HMOs or non-standard constructions, may be considered higher risk and require specialised lenders.

How can a mortgage broker help if my application is declined?

A broker can assess your situation, identify suitable lenders, and guide you on improving your application to avoid future rejections.

Is self-employment a common reason for a Buy-to-Let mortgage decline?

It can be if income documentation is unclear. Providing comprehensive financial records can improve your chances.

Can I switch lenders if my Buy-to-Let mortgage was declined?

Yes, but you’ll need to understand why the initial application was rejected to avoid repeating the same mistakes.

What documents should I double-check to avoid a decline?

Ensure your income proof, rental income projections, deposit, and credit history are accurate and align with the lender’s requirements.

Client Testimonial

Client Testimonial

“I heard about Power Mortgages through a friend who had used their services for a Buy to Let mortgage. After facing challenges and being declined by a couple of high street banks for an interest-only mortgage, I decided to give them a call. I spoke to Steve; he immediately took the time to understand my situation and reassured me that we could find a solution. He talked me through all the different options and explained how we could structure the mortgage to fit my needs. The level of personalised service is really great. Steve made the whole process easy to understand and kept me updated every step of the way.”

Kwame Adu