Portfolio Landlord Mortgages

Expert Mortgage Solutions for Expanding and Managing Your Property Portfolio

Tailored Advice for Portfolio Landlords

We offer in-depth guidance to help you understand portfolio landlord mortgages and find the best deals for your property goals.

Smooth Application Management

Let us handle the paperwork and streamline your application process, ensuring a hassle-free experience.

Understanding Portfolio Landlord Mortgages

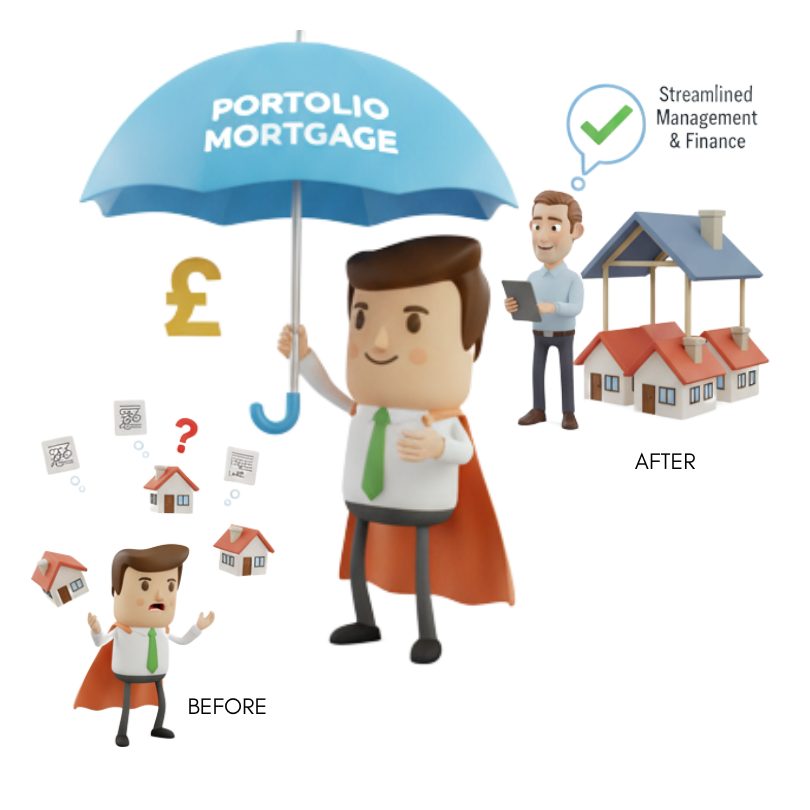

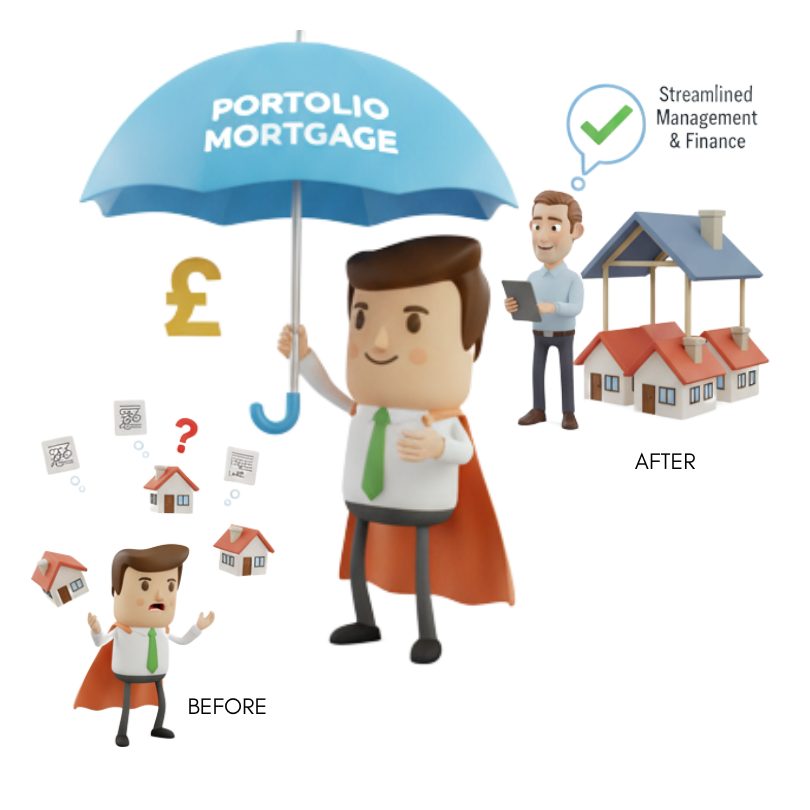

Portfolio Landlord Mortgages are specifically designed for property investors who own multiple rental properties. These mortgages allow landlords to consolidate their properties under one umbrella, simplifying management and finances.

With a portfolio mortgage, you can secure one loan to cover multiple properties, rather than applying for separate loans for each one. This can save time, paperwork, and potentially lower costs.

Lenders assess the overall risk and performance of your entire property portfolio rather than individual properties. This means that if one property is underperforming, it won’t necessarily affect your entire application.

By combining properties, you can simplify the complexity of managing multiple mortgages, making your property investment strategy more streamlined and efficient.

Portfolio mortgages offer more flexibility compared to traditional buy-to-let mortgages. You may also have the option to release equity or refinance multiple properties at once.

Understanding Portfolio Landlord Mortgages

Portfolio Landlord Mortgages are specifically designed for property investors who own multiple rental properties. These mortgages allow landlords to consolidate their properties under one umbrella, simplifying management and finances.

With a portfolio mortgage, you can secure one loan to cover multiple properties, rather than applying for separate loans for each one. This can save time, paperwork, and potentially lower costs.

Lenders assess the overall risk and performance of your entire property portfolio rather than individual properties. This means that if one property is underperforming, it won’t necessarily affect your entire application.

By combining properties, you can simplify the complexity of managing multiple mortgages, making your property investment strategy more streamlined and efficient.

Portfolio mortgages offer more flexibility compared to traditional buy-to-let mortgages. You may also have the option to release equity or refinance multiple properties at once.

Who Can Apply for a Portfolio Landlord Mortgage?

To be eligible for a Portfolio Landlord Mortgage, you typically need to meet certain criteria set by lenders. The main requirement is that you own multiple properties.

Generally, lenders expect you to own at least four buy-to-let properties to apply for a portfolio mortgage. This is because lenders want to see experience in managing multiple properties.

The rental income from your properties is crucial to your eligibility. Lenders assess whether this income is enough to cover your mortgage payments and other associated costs.

A strong credit history and solid financial standing are also important. Lenders are more likely to approve applications from landlords with a good credit score, showing a history of responsible financial management.

Your experience as a landlord will be considered when applying. Lenders may assess your ability to manage your portfolio, including how well you maintain properties and handle tenants.

Some lenders may also inquire about your future plans for expanding your portfolio. They want to see that you have a clear strategy and that the properties are likely to remain profitable.

How a Mortgage Broker Can Support Portfolio Landlords

A mortgage broker is an invaluable partner when applying for a portfolio landlord mortgage. They offer expert guidance, help streamline the application process, and can help you find the best deals.

Brokers have access to a wide range of lenders, including specialist lenders who focus on portfolio mortgages. This means they can find lenders that best suit your needs.

They’ll explain the specific requirements for portfolio mortgages and guide you through the application process. Brokers ensure that you meet the necessary criteria and that your paperwork is in order.

A broker will assess your entire portfolio and recommend the most appropriate mortgage products based on your property type, rental income, and future goals.

Handling the paperwork and communicating with lenders can be a time-consuming task. A mortgage broker takes care of all this, leaving you with more time to focus on growing your property business.

Working with a broker also provides you with access to exclusive deals and competitive rates that may not be available directly from lenders. This could lead to more favourable mortgage terms and savings in the long run.

How a Mortgage Broker Can Support Portfolio Landlords

A mortgage broker is an invaluable partner when applying for a portfolio landlord mortgage. They offer expert guidance, help streamline the application process, and can help you find the best deals.

Brokers have access to a wide range of lenders, including specialist lenders who focus on portfolio mortgages. This means they can find lenders that best suit your needs.

They’ll explain the specific requirements for portfolio mortgages and guide you through the application process. Brokers ensure that you meet the necessary criteria and that your paperwork is in order.

A broker will assess your entire portfolio and recommend the most appropriate mortgage products based on your property type, rental income, and future goals.

Handling the paperwork and communicating with lenders can be a time-consuming task. A mortgage broker takes care of all this, leaving you with more time to focus on growing your property business.

Working with a broker also provides you with access to exclusive deals and competitive rates that may not be available directly from lenders. This could lead to more favourable mortgage terms and savings in the long run.

Frequently Asked Questions

Frequently Asked Questions about Portfolio Landlord Mortgages

What is a portfolio landlord mortgage?

A portfolio landlord mortgage is a type of mortgage for property investors who own multiple rental properties. It allows landlords to consolidate their properties under one loan, streamlining the management and financing of their portfolio.

How many properties do I need to own to apply for a portfolio landlord mortgage?

Typically, you need to own at least four buy-to-let properties to qualify for a portfolio landlord mortgage. Lenders want to see experience in managing multiple properties.

How do lenders assess portfolio landlord mortgage applications?

Lenders assess the overall risk and performance of your entire property portfolio. They’ll look at factors such as rental income, property values, and your financial standing, rather than focusing on individual properties.

Can I use a portfolio landlord mortgage to buy new properties?

Yes, you can use a portfolio landlord mortgage to fund the purchase of additional properties within your portfolio, as long as the lender’s criteria are met.

What is the maximum loan I can get for a portfolio landlord mortgage?

The maximum loan amount depends on the total value of your portfolio, your rental income, and other factors like your credit history. Generally, the larger your portfolio, the higher the loan you can secure.

Do portfolio landlord mortgages offer better rates than traditional buy-to-let mortgages?

Do I need a high credit score to qualify for a portfolio landlord mortgage?

Can I release equity from my portfolio using a portfolio landlord mortgage?

Are portfolio landlord mortgages suitable for first-time investors?

What are the benefits of using a portfolio landlord mortgage?

How long does it take to get approval for a portfolio landlord mortgage?

The approval process for a portfolio landlord mortgage can take longer than a standard buy-to-let mortgage due to the complexity of the application. It typically takes a few weeks but may vary depending on the lender and the specifics of your portfolio.

Can I use a portfolio landlord mortgage for commercial properties?

Client Testimonial

“When my husband and I decided to rent out our home instead of selling, we quickly realised that switching to a Buy to Let mortgage wasn’t as straightforward as we had hoped. Our existing lender had strict criteria, and we struggled to find a new deal that worked for us.

Thankfully, John guided us through the entire process. He took the time to understand our situation, found a lender that suited our needs, and secured us a competitive deal. His knowledge and patience made everything so much easier. We couldn’t have done it without him, and we’re now successfully renting out our property with peace of mind!”

Arjun Malhotra

Client Testimonial