Release Equity From your Buy-to-Let Mortgage

Release Capital from Your Buy-to-Let Mortgage

If you’re looking to release funds from your Buy-to-Let property for further investments or property improvements, raising capital through your mortgage could be the perfect solution. By releasing equity, you can unlock the value tied up in your property and use it for a range of purposes, such as buying additional rental properties or upgrading your current ones.

What is Releasing Equity from a Buy-to-Let Mortgage?

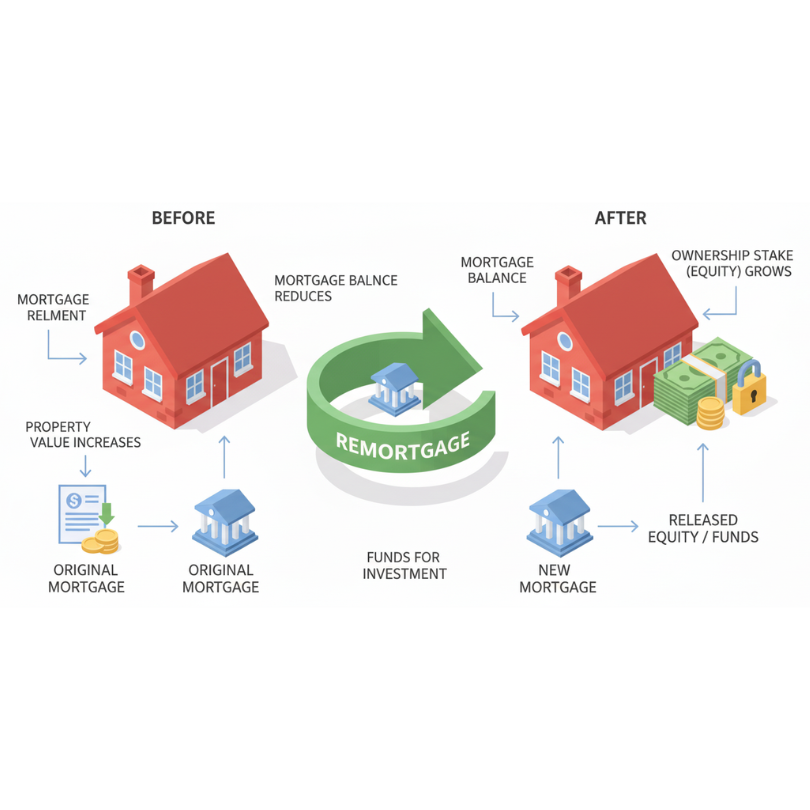

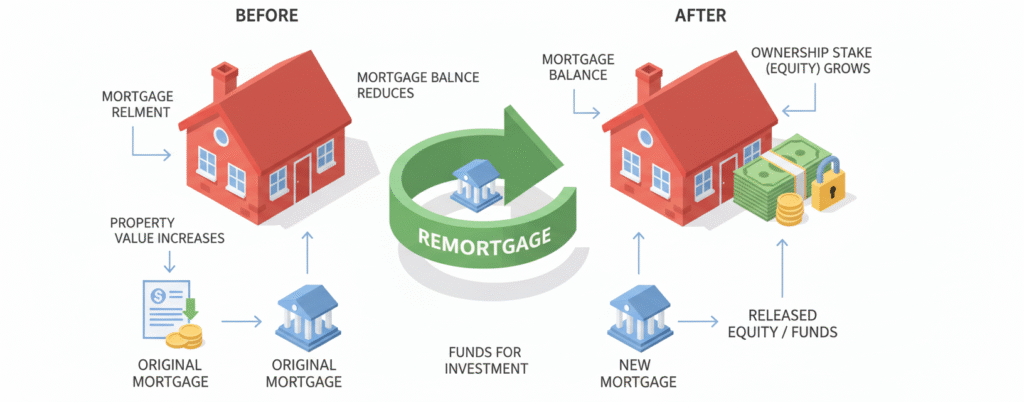

Releasing equity from a buy-to-let mortgage allows you to borrow against the increased value of your rental property. Over time, as the property value rises and your mortgage balance reduces, your equity—your ownership stake in the property—grows.

By remortgaging or taking out a loan, you can access a lump sum or a flexible loan facility. This can be used for a variety of purposes, such as expanding your property portfolio, funding home improvements, or other investment opportunities.

What is Releasing Equity from a Buy to Let Mortgage?

Releasing equity from a buy-to-let mortgage allows you to borrow against the increased value of your rental property. Over time, as the property value rises and your mortgage balance reduces, your equity—your ownership stake in the property—grows.

By remortgaging or taking out a loan, you can access a lump sum or a flexible loan facility. This can be used for a variety of purposes, such as expanding your property portfolio, funding home improvements, or other investment opportunities.

Who is Eligible to

Release Equity from a

Buy-to-Let Property?

Eligibility to release equity typically requires you to have owned your buy-to-let property for at least six months, although requirements may vary by lender. Your rental income needs to be sufficient to cover any increased repayments, and lenders will assess your credit history and financial standing.

Lenders may also have age requirements, generally starting at 21. Working with a mortgage broker can help streamline this process, as they have access to lenders who specialise in equity release and can match you with the best options based on your circumstances.

How Can a Mortgage Broker Help with Releasing Equity?

A mortgage broker plays a crucial role in navigating the equity release process. They have access to a wide range of lenders, including those offering specialised equity release options for buy-to-let properties. Brokers provide expert advice, helping you understand your eligibility and the best way to proceed.

They manage the application process, ensuring you submit the necessary documentation and receive competitive rates. With their guidance, you can make informed decisions and secure the best deal for your financial goals.

At Power Mortgages, we make the process simple and stress-free. Our expert team will guide you through the steps, helping you understand how equity release works and ensuring you get the best deals available. Whether you’re a seasoned landlord or just starting out, we’re here to help you make the most of your Buy-to-Let investment.

How Can a Mortgage Broker Help with Releasing Equity?

A mortgage broker plays a crucial role in navigating the equity release process. They have access to a wide range of lenders, including those offering specialised equity release options for buy-to-let properties. Brokers provide expert advice, helping you understand your eligibility and the best way to proceed.

They manage the application process, ensuring you submit the necessary documentation and receive competitive rates. With their guidance, you can make informed decisions and secure the best deal for your financial goals.

At Power Mortgages, we make the process simple and stress-free. Our expert team will guide you through the steps, helping you understand how equity release works and ensuring you get the best deals available. Whether you’re a seasoned landlord or just starting out, we’re here to help you make the most of your Buy-to-Let investment.

Frequently Asked Questions

Frequently Asked Questions about Releasing Equity from a Buy-to-Let Mortgage

What is equity release from a buy-to-let mortgage?

Equity release from a buy-to-let mortgage involves borrowing against the value of your rental property. This allows you to access funds tied up in the property, which can be used for investments, improvements, or other financial needs.

How do I release equity from my buy-to-let property?

You can release equity by remortgaging your property or taking out a further advance against your existing mortgage. This process typically involves increasing your mortgage balance, allowing you to access the extra funds.

Who is eligible for equity release from a buy-to-let mortgage?

Eligibility typically requires you to have owned your buy-to-let property for a minimum of six months, though this can vary by lender. Your rental income must be enough to cover the repayments, and lenders will also assess your credit history and financial situation.

How much equity can I release from my buy-to-let property?

The amount you can release depends on the property’s value, your current mortgage balance, and your rental income. Lenders may offer up to 75-80% of the property’s value, minus your current mortgage balance.

Can I release equity from multiple buy-to-let properties?

Yes, it is possible to release equity from more than one buy-to-let property. This may involve remortgaging individual properties or combining them under a portfolio loan.

What can I use the equity for?

You can use the released equity for various purposes, such as purchasing more properties, making home improvements to increase rental value, consolidating debt, or funding personal investments.

Are there any tax implications for releasing equity from a buy-to-let mortgage?

Equity release may have tax implications, especially if the funds are used for personal expenses or investments. It’s advisable to speak with a financial advisor to understand potential tax liabilities, including Capital Gains Tax.

How is the interest calculated when I release equity from my buy-to-let mortgage?

Interest on the released equity is usually calculated in the same way as your original mortgage. It will be based on the interest rate set by the lender and added to the total mortgage balance.

Do I need a good credit score to release equity from a buy-to-let mortgage?

While having a good credit score can help secure better rates and terms, lenders may still consider your rental income and the property’s value. If your credit score isn’t excellent, you may still be eligible, but the terms may not be as favourable.

How long does it take to release equity from a buy-to-let mortgage?

The process typically takes between 4-8 weeks, depending on the lender and complexity of your application. Having all required documentation in place can speed up the process.

Can I release equity if I have an existing buy-to-let mortgage with a high loan-to-value ratio?

If you already have a high loan-to-value (LTV) ratio, it may be more challenging to release equity. However, it may still be possible if your property value has increased significantly or if you have a strong rental income.

Can I release equity if I am a portfolio landlord?

Yes, portfolio landlords can release equity from their properties. In fact, some lenders offer portfolio buy-to-let mortgages, allowing you to release equity from multiple properties at once, which can streamline the process.

What are the risks of releasing equity from a buy-to-let mortgage?

The risks include increasing your mortgage repayments, which may affect your cash flow, especially if rental income fluctuates. Additionally, borrowing more can reduce your overall profitability, and you’ll be paying more interest over time.

Will releasing equity from my buy-to-let property affect my tax status?

Releasing equity could affect your tax situation depending on how the funds are used. For example, using the funds to buy another property might be treated differently than using it for personal expenses. Consulting a tax advisor is recommended.

Can I release equity from a buy-to-let mortgage if the property is in a limited company name?

Yes, you can release equity from a buy-to-let property held in a limited company name. However, the process may differ slightly, as lenders may have different criteria and consider the financial health of your business as well as the property value.

Client Testimonial

“I needed to release some equity from one of my Buy to Let properties to fund a renovation on another, but I wasn’t sure how to go about it or if it was even possible with my current lender. Steve at Power Mortgages made the whole thing straightforward. He explained my options clearly, found a lender that fitted my needs at a better rate than my existing lender, and handled the process quickly. Very happy.”

Mark Henson

Client Testimonial